The Developer's Playbook

Last week at Climate Week NYC, we hosted "The Developer's Playbook" workshop at the Node FOAK Summit. Alongside amazing practitioners from Celium and Focus Green Solutions, we dove deep into the frameworks and tactics that separate successful first-of-a-kind (FOAK) projects from those that stall in the "valley of death."

The room was packed with developers, investors, and operators all wrestling with the same question: How do we bridge the gap between technical feasibility and financial close?

Here is a link to the blank Stage Gate worksheet

The $2 Trillion Problem Nobody's Talking About

Here's the uncomfortable truth: capital abundance isn't our biggest problem. There's plenty of money waiting to flow into bankable, construction-ready clean energy projects. The real bottleneck? Capital formation and delivery for early-stage projects.

We need $4.5 trillion per year in clean energy infrastructure spend to reach Net Zero by 2030, and more than 50% of the emissions cuts required will come from technologies that aren't yet commercially de-risked. But there's a $15 trillion infrastructure finance gap between what we need and what we're actually deploying.

The challenge isn't finding money. It's getting that money to move at the speeds and risk profiles that FOAK projects require.

What Actually Makes a Project "FOAK"?

One of the first things we clarified in the workshop: FOAK means different things to different people.

For VCs and tech companies, FOAK often means fundamental science risk (think fusion or novel chemistry). But for project financiers, FOAK typically means one of two things:

Engineering/integration risk: Deploying existing technology in new ways (modular nuclear, repurposed EV batteries for grid storage)

Commercial structure risk: Proven technology in proven applications, but with novel business models or contract structures

This distinction matters because it changes everything about your capital strategy, timeline, and development approach.

The Stage-Gate Process: Your Roadmap Through the Valley of Death

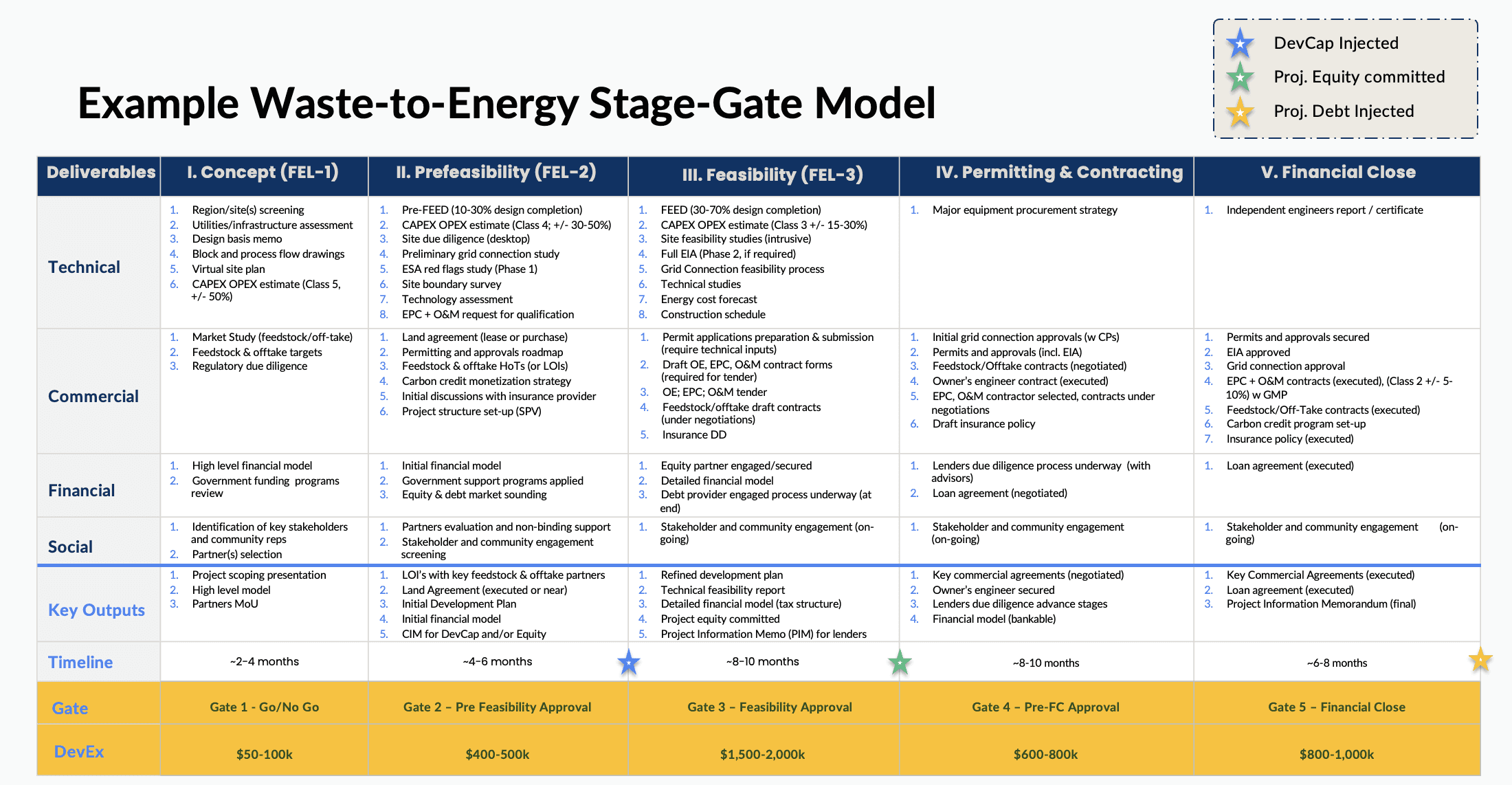

One of the most valuable frameworks we walked through was the development stage-gate process: a systematic approach where projects must prove readiness at each gate before advancing:

Phase I - Concept (FEL-1): Macro-level analysis, site screening, rough cost estimates (±50%)

Phase II - Prefeasibility (FEL-2): Options analysis, identifying critical hurdles, Class 4 cost estimates (±30-50%)

Phase III - Feasibility (FEL-3): Detailed technical work, Class 3 costs (±15-30%), comprehensive risk assessment

Phase IV - Permitting & Contracting: Securing approvals, finalizing agreements, preparing for financial close

Phase V - Financial Close: Loan execution, final documentation, first drawdown

The key insight? Your project model should mature with your project. A Class 5 cost estimate in FEL-1 is appropriate; carrying that same estimate into FEL-3 is a red flag.

Project Models: The Universal Language of Infrastructure Development

If you're developing FOAK projects, your project model isn't just a spreadsheet. It's your primary communication tool with capital providers, partners, and stakeholders.

The best project models serve dual purposes:

Decision-making tools for developers (scenario analysis, sensitivity testing, trade-off evaluation)

Communication and diligence tools for capital providers (demonstrating maturity, justifying performance claims)

We shared some hard truths about common modeling errors that kill credibility:

Unrealistic energy cost assumptions

Bottom-up CapEx builds without reference data

Missing supply chain constraints

Physics violations (yes, this still happens)

Outdated reference costs from 2019 carried into 2024 models

The standard is high because the stakes are high. Your model reflects your project's maturity and your team's sophistication.

The Modern Developer Stack: Beyond Excel

The good news? The tools available to developers today are transforming what's possible:

LLMs for data extraction (Claude, GPT-4) reduce the tedium of pulling information from PDFs and technical documents

Agentic workflow builders (Cursor, n8n) bring updated data into models automatically

Developer datasets (Halcyon, Paces) provide regulatory compliance and geospatial analysis without custom builds

Smart data rooms (Thresh, Euclid Power) enable secure document sharing that actually works

But here's the challenge: these are point solutions. Most developers are still stitching together 5-10 different tools, manually moving data between systems, and losing valuable context in translation.

What's Next: Building the Category

The workshop reinforced something we've believed for a while: FOAK project development needs its own category of infrastructure. Not another Excel template, not another project management tool. An integrated platform that understands the development stage-gate process and enables teams to move faster with higher confidence.

That's exactly what we're building at Aire Labs: a platform that combines modern AI capabilities with project finance best practices, helping developers navigate from concept to financial close with the rigor that capital providers expect.

The Takeaway

If there's one thing we hope everyone walked away with, it's this: becoming a bankable asset class isn't magic. It's a systematic process of reducing uncertainty, documenting assumptions, and demonstrating readiness at each stage gate.

The developers who succeed aren't necessarily the ones with the best technology. They're the ones who understand the language of project finance and can communicate their project's pathway to bankability.

Huge thanks to Mihir Desu from Celium and Amit Modi from Focus Green for co-presenting, and to everyone who joined us at the Node FOAK Summit. The conversations we had afterward were just as valuable as the workshop itself.

Want to continue the conversation? Reach out at ari@airelabs.com or check out what we're building at airelabs.com.